The Barnard Observer

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

Home Vault Misc Contact c2003-10 Thomas Barnard

The Power of Rhetoric

The Dyson Vacuum Cleaner

The thread starts here. I saw my friend Rachel Weaver post on Facebook that she was wondering what to do about her vacuum cleaner problem. She had two Dyson's which were non-functioning.

I stopped by their shop, a bookstore (http://www.booktable.net).

Me: "So what's the story with the Dysons? I thought they were supposed to be designed to perfection."

Rachel: "If you look at the path where the air goes, it looks very complicated if you compare it with a conventional." (She showed me a diagram).

Me: "It (the air flow) looks like one of those Bose speakers."

Rachel: "Maybe it's just not good for daily use."

Jason (her husband): "Too many plastic parts."

Rachel: "My brother wants me to buy a third, the Dyson with the big ball, but with two not working, that's not likely."

Me: (finally, in this post)

Maybe it's only good for use in commercials.

All of which is to make a point. And that point is the power of rhetoric. Rhetoric, a word which I never understood and always hated. Funny looking odd word. A word which only Aristotle understood.

Wiki says it "is the art of using language to communicate effectively." The second meaning under Webster says, "the study of writing or speaking as a means of communication or persuasion." Okay, bingo. It's advertising copy.

Certainly, the fellow in the commercial had me sold. Perfect suction. No bags, belts or filters to buy, so they don't cost a dime to maintain. The only thing holding me back was the price, which seemed like it was double the price of a Hoover. Which brings me back to my theme: superior rhetoric commands a higher price.

Pumpers and Bashers

Now let me click and drag, and bring this rhetoric thing over to stocks. If you've ever visited the Yahoo message boards for stocks, it appears to be almost a screaming rage of voices, an unbearable din. Some of these voices appear in blogs, some more public than others. On one of my stocks, a public blogger bashed the stock I own holding, calling it "crap," more or less. (How's that for rhetoric?) The company was liars and they couldn't be believed. Now, he may be right, but the people behind the company certainly seem legitimate to me, so I'm staying with it. But the blogger had his way. The stock took a 30% haircut. The company reacted by launching a lawsuit for millions. Actually, I hope they succeed, it would be a unique way to help them to finance the development of their product, which, if it works, will be a godsend to millions.

It would be wonderful to get the full story here about pumpers, who are pressing for a higher stock price, and bashers who want to knock them down. Certainly, these people may be maintained, for example, by companies wishing to get a higher stock price, and say, potential suitors to a company, wanting to keep the price down at all costs, so they can buy it on the cheap.

What little I know is interesting. I know that one of the pumpers on the Yahoo message board for Whole Foods was the CEO John Mackey himself, who was predicting an outrageously high stock price. When it was leaked, it did cause all manner of embarrassment for Mackey and Whole Foods. But I suspect that this stuff is more pervasive and intriguing than we know.

Chief Rhetoric Officer

At least one company I own a small piece of has shares in witness relocation. The stock price and absence of trading tell you that no one knows they exist. I've held the shares forever, and I think they have something special, but between the acronyms and the jargon, it is hard to figure out without a score card. And if it hadn't landed on my doormat via a mailing, how would anyone know about it out? The answer is that they don't know about it. They badly need a Chief Rhetoric Officer, and I will propose myself.

Defined Benefits Revisited

This comes to me from one of my readers, a cousin. I have changed the names to protect the innocent, not the guilty. He writes to me:

"As you may know already, I am retiring next month and will begin receiving a monthly pension from a defined benefit program, that will be at least 60% of my current wage every month, for the rest of my life. If I live an additional 30 years the accumulated pension compensation will amount to over 40 times of what I paid into it. Right now the pension fund says it is over 85% funded through 2030 so I will probably see most, if not all, of that money. I agree these are lavish amounts of compensation and probably won’t endure another quarter century. I have included below a story of pension atrocity.

"This individual, K.C. a resigning police sergeant with the Village of Stoidi PD, making at least $113,000 per year, will probably begin receiving a policeman’s pension this year and for the rest of his life, in the neighborhood of 75% of his ending wage. He will then continue working in the same job, in the same capacity, doing the exact same tasks, but he will no longer do it as a policeman, he will now do it as the Village of Stoidi “Inspector General” with a beginning annual wage of about $80,000. He will be enrolled in the Municipal Pension Plan and he will be “vested” after eight years. He is now 31 years old, if he works this job for an additional 30 to 35 years he will be able to retire with the municipal pension too, worth 75% of his ending wage at that time in the future. A very rough guesstimate then, is that when he retires from the Village employment in, say, 2045 with 35 years service credit he will accumulate over twelve million dollars if he lives to age 90 by double dipping into two pensions. He will of course begin receiving his social security monthly pension starting at age 65 which may be worth an additional million dollars to him, if social security is still solvent."

I thought this story was so fabulous that I had to share it with you. I might doubt its authenticity but my cousin is a very candid fellow, just this side doing himself injury with his candidness. Example: in his close-out interview, he expressed concern for the financial welfare of the village willing to give him the "package," and granting him a pension at 50.

Well, these municipal pension systems have been set up, and it takes only a resourceful fellow to game them. Obviously, there are gamers in your local law enforcement, fire departments and school systems equal to the schemers at Goldman. We need financial reform equal to what the feds are doing at the local level. I could imagine at some point, tax payers will say this is what we'll give you. You figure out who gets what pension, who gets what pay, as pensioners who were granted what they knew (witness my cousin) were unsupportable pensions are pitted against new teachers. Will new teachers get the pittance their great grandparents got as teachers, and so keep pensioners on the ridiculous commitments made decades ago? Or will they insist on reasonable pay at the expense pensioners? As it is now, taxpayers, in the midst of the most serious financial reversal in decades are expected to continue both as these important groups are in the protected "no pay cut zone." The result of the current status is that tax are going up, witness my friend in the next community over from me seeing a 48% increase in their real estate taxes.

All kinds of possible solutions may present themselves. Instead of trying for some reasonable sacrifices on all sides. Boards of Education may fire all the teachers because there are plenty around as many Catholic schools have closed, and hire all new. And so on. I write on this issue because it such a pervasive problem, maybe first showing up in Greece, but seems endemic to all state and local governments. Perhaps we will move back to a draft for the armed forces because voluntary pay is too high.

Boy Was I Wrong

I thought Whole Foods was high when it reached $29. It is now past $40, and sports a PE of 34. Good for Mackey. Why shouldn't he post for his company?But the stock's too rich for my blood. I'd need the butcher to cut off a lot of fat.

Citibank Update

I recommended Citibank a while back. Since then there has been some commotion.

Soros sold his stake. (5/17/10)

Paulson is standing pat. (5/18/10)

Goldman Sachs raised Citibank to Buy from Neutral (5/24/10)

The U.S. government sold 20% of its stake, and is looking to sell the rest. Downward pressure on shares. (5/26/10)

Qatar is thinking of taking the rest of the U.S. stake. (5/26/10 NYT blog)

Jim Cramer said it's not too late to buy Citi. (5/27/10)

Bill Ackman said his Pershing Square bought 150 million shares (5/26/10)

Dick Bove of Rochdale Securities says the stock should be "aggressively bought." (6/2/10)

If the government persists in selling shares in what looks like a dumping action, then it will take some time for the stock to be able to get any traction. I don't think the downside is tremendous, but the then the upside doesn't look that interesting, either. I'm holding for now. From here, I think $7 or $8 is a reasonable three year prediction.

I'm looking at oil. Demand has not been great, and it doesn't look to improve immediately. Presently, it is the geo-political that would draw me in, and even though I read a very persuasive newsletter on the issue, I'm waiting.

PE Ratios, Regression to the Mean

The last time I addressed this issue was November of 2009. There is always the risk of massive re-pricing. Regression to the mean is nor-mal, as the Europeans always say. And I would expect it to stay there for a year. The last time we have seen PE's in single digits is 1984. Here's your brief:

1917-25, World War I and on into the twenties (8 years)

1932, the bottom of the Great Depression

1942, U.S. enters World War II

1949, U.S. enters Korean War

1974, the great recession

1977-84, the great inflation (7 years)

This is the longest period in the last 100 years since we have not had a dip into single digits, which is something not to be smug about. It is something to worry about. Nevertheless, I'm going out on a limb and say (against my conservative nature, again), probably not this year. The first reason I'm going to say this is because that according to the pundits, the little guy did not get in, and he always gets in just before it's going to crater. Second, my intelligent friends are staying out of the market, keeping their free cash high, creating that wall of worry that must be overcome on the upside. We may actually have to go back to 14,000 to get all the suckers in to achieve that level of confidence that brings the market back down. But if it goes back down at that point, it would be devastating.

I would prefer it if earnings increased and prices stayed the same until it achieved a lower PE. Sort of like what has happened to Microsoft over the past 10 years, only for the whole market. Ten years ago, Microsoft had a PE of above 40. The stock has done nothing for 10 or a dozen years, and now the PE is 13.92.

The biggest risk is probably geo-political, not internal. This - in spite of a still horrendous real estate market. But to reiterate an email I sent to some of you a week or two ago, we have a lot standing between us and 1929. We do not have Andrew Mellon trying to balance the budget by increasing the top tax rate from 25% to 63%. We do not have Smoot-Hawley with tariffs on 1200 some products. We do not have a Fed that failed to be accommodative. We did have a serious Secretary of the Treasury, Hank Paulson, who with Bernanke, avoided a massive, systemic failure of the banking system with the TARP program. We did have a Stimulus Bill (which I hated, principally because it was junk and pork labeled stimulus). We did have a Fed Chairman who is an expert in the Great Depression, and he brought interest rates down to nothing, and who supported the mortgage market. This is a lot.

If you want to worry about something, worry about this: reports are that since the Fed stopped supporting the mortgage market and the incentive program ended, the real estate market has died again. Proving only that it was on life support.

Investors Intelligence, Bullish Advisors 39.8%, Bearish Advisors 28.4% (6/1/10), down from 47.2% and 24.7% respectively, four weeks ago. Less bullish, but not quite out and out bearish enough to be bullish (it's a reverse indicator, lest you get confused).

May 28, 2010

= = = = = = = = = = =

Sponsors

I want to own more of these stocks. I have bought more than I reasonably should commit to these paradigm-changing, late stage developmental stocks. And so I conjured up the Stock Recommendation Partnership, so that I could piggyback on your ownership. I think it's highly unlikely that you'll find these stocks on your own. I've done a lot of the waiting for you. Years worth.

These are stocks of unusual potential. But the risk is always bigger with nascent companies. One of the stocks has recently run-up more than 100%, the other one has gone down 30%. Never mind, I love them both still. The one that has gone up, has only begun. The one that has gone down has one of the most compelling stories I have ever come across. There is so much compression, these both have a long way to go on the upside.

Stock Recommendation Partnerships. Presently, I have two such recommendations. These are stocks I just can't get enough of for my own account. You own the stock in your account, but a percentage of the winnings go to Thomas Barnard for his recommendations.

Here is the agreement: Stock Recommendation Partnership Agreement. No agreement no matter how well drawn is sufficient. If I don't know you personally, don't bother. If I do know, now is a good time to check this out.

Email: tbbarnard@yahoo.com

- - - - - - - - - - - - - -

M.E. Reiss Ltd. Select investment management. Email: mereiss@yahoo.com

- - - - - - - - - - - - - -

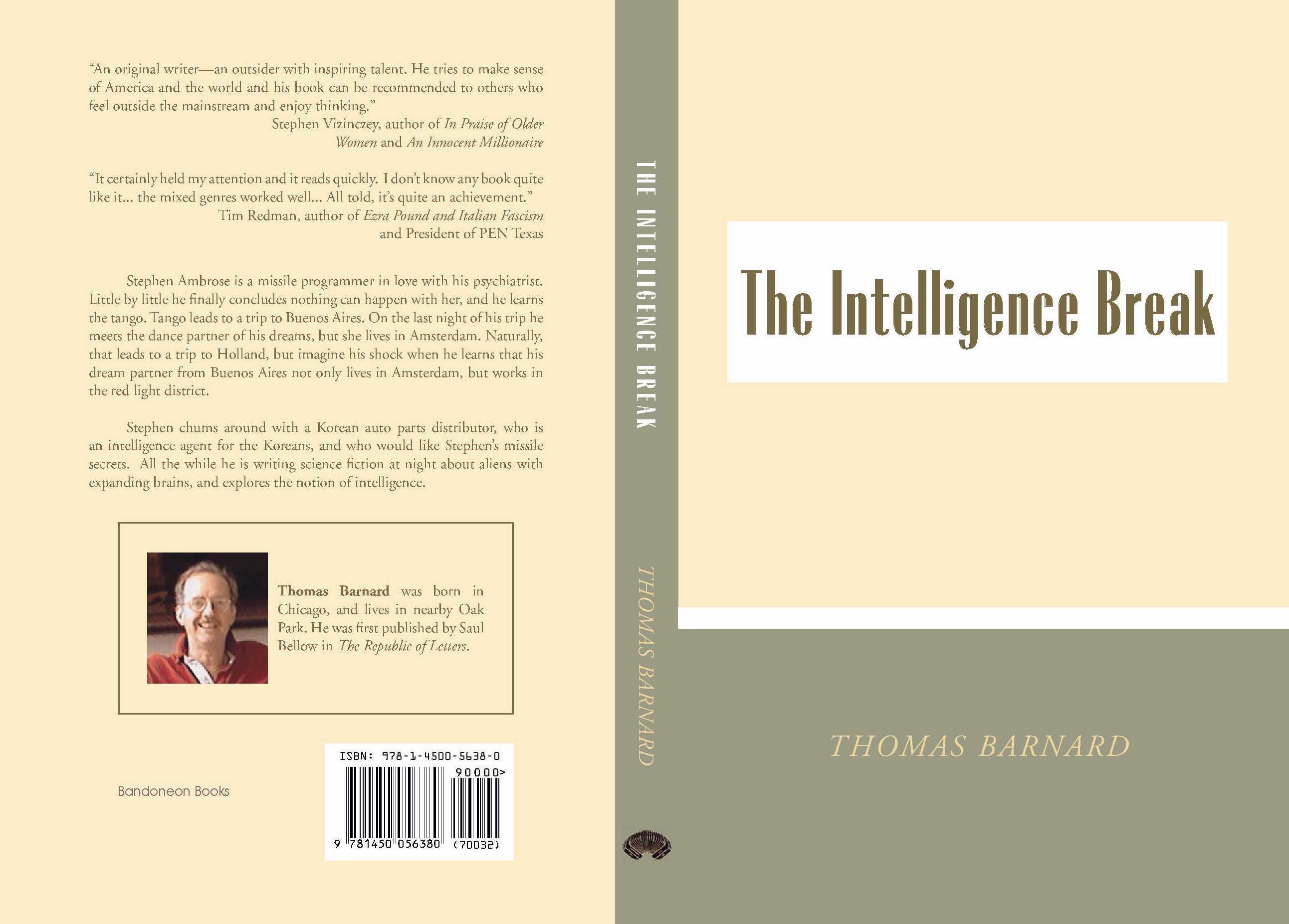

Coming Out in Weeks!

The Intelligence Break, a novel about the curious relationship between brains and sex

Check it out: http://www.theintelligencebreak.com/

And to those within striking distance of Oak Park, the book I expect should be available some time in June at:

The Book Table

1045 Lake Street

Oak Park, IL 60301

708-386-9800