The Barnard Observer

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

Home Vault Misc Contact c2003-10 Thomas Barnard

[fragment]

The Dragon Bubble

The Chinese Housing Bubble

There is a housing bubble in China. It is perhaps of epic proportion because China has been using housing to generate its 9%+ annual growth. Construction is 50%-60% of the economy.

I would urge readers to look for Jim Chanos on the subject. There was an excellent interview on Charlie Rose, which appeared in Bloomberg Business Week in abridged form. I saw a clip on YouTube and I read the entire text. It's the same stuff you saw in Miami, empty condo units. And ultimately, the same problem: how can a Chinese couple making $8,000 support the payments for a $150,000 condo? It relies on the greater fool theory which drove the American real estate market.

Charlie Rose asked Chanos how this could happen when the Chinese have $2 trillion in foreign currency reserves, but Chanos shot back: the U.S. had huge currency reserves in 1929, and the Japanese had huge currency reserves in 1989. Bubbles will have their way.

Chanos seems to feel that the Chinese government will assume the debt (nationalize it). He feels the government will try to maintain 9% growth even with this stumbling block, but suggests there will be huge dislocations. He feels whatever effects there are will hit late 2010 or into 2011.

Charlie Rose/Jim Chanos clip: http://www.youtube.com/watch?v=q9AsyCN11io

The Barnard Principle

[Apparently, I used this file to start the letter instead of copying to it at the end]

I'm wondering exactly what principle I was after here. If someone remembers, or copies out these things, please fax or send to me, Fax 708-386-0928 or Email tbbarnard@yahoo.com.

Cable TV

Malone is going after German cable, which is only $20 per month versus America's $119 per month. Once again, it's reverse time for me: why is American cable so expensive? I balked. I'm going with ultra basic cable as an experiment. I'm not happy, but more and more stuff is becoming available over the internet. I can still get most of CNBC. Hulu has The Family Guy, House, and others.

What Dad is Up These Days

"I'm telling my advisers to look for dividends. I'm tired of managements who ignore their shareholders." I think this would be a good development. Even though congressmen have continually ignored the double taxation of dividends, there might be a good reason to do this. It might have a salutory effect on managements in this country, and perhaps managements would be prone to consider their shareholders because those companies paying dividends would be in demand.

May 15, 2010

= = = = = = = = = = =

Sponsors

If you think stocks will continue to rise, then this is the moment. Mergers and buyouts everywhere. I am recommending two paradigm changing developmental stocks. These are stocks of unusual potential. But the risk is always bigger with nascent companies. One of the stocks has recently run-up more than 50%, but this is nothing, there is so much compression, it's got a long way to go.

Stock Recommendation Partnerships. Presently, I have two such recommendations. These are stocks I just can't get enough of for my own account. You own the stock in your account, but a percentage of the winnings go to Thomas Barnard for his recommendations.

Here is the agreement: Stock Recommendation Partnership Agreement. No agreement no matter how well drawn is sufficient. If I don't know you personally, don't bother. If I do know, now is a good time to check this out.

Email: tbbarnard@yahoo.com

- - - - - - - - - - - - - -

M.E. Reiss Ltd. Select investment management. Email: mereiss@yahoo.com

- - - - - - - - - - - - - -

Coming Soon to a Link Near You!

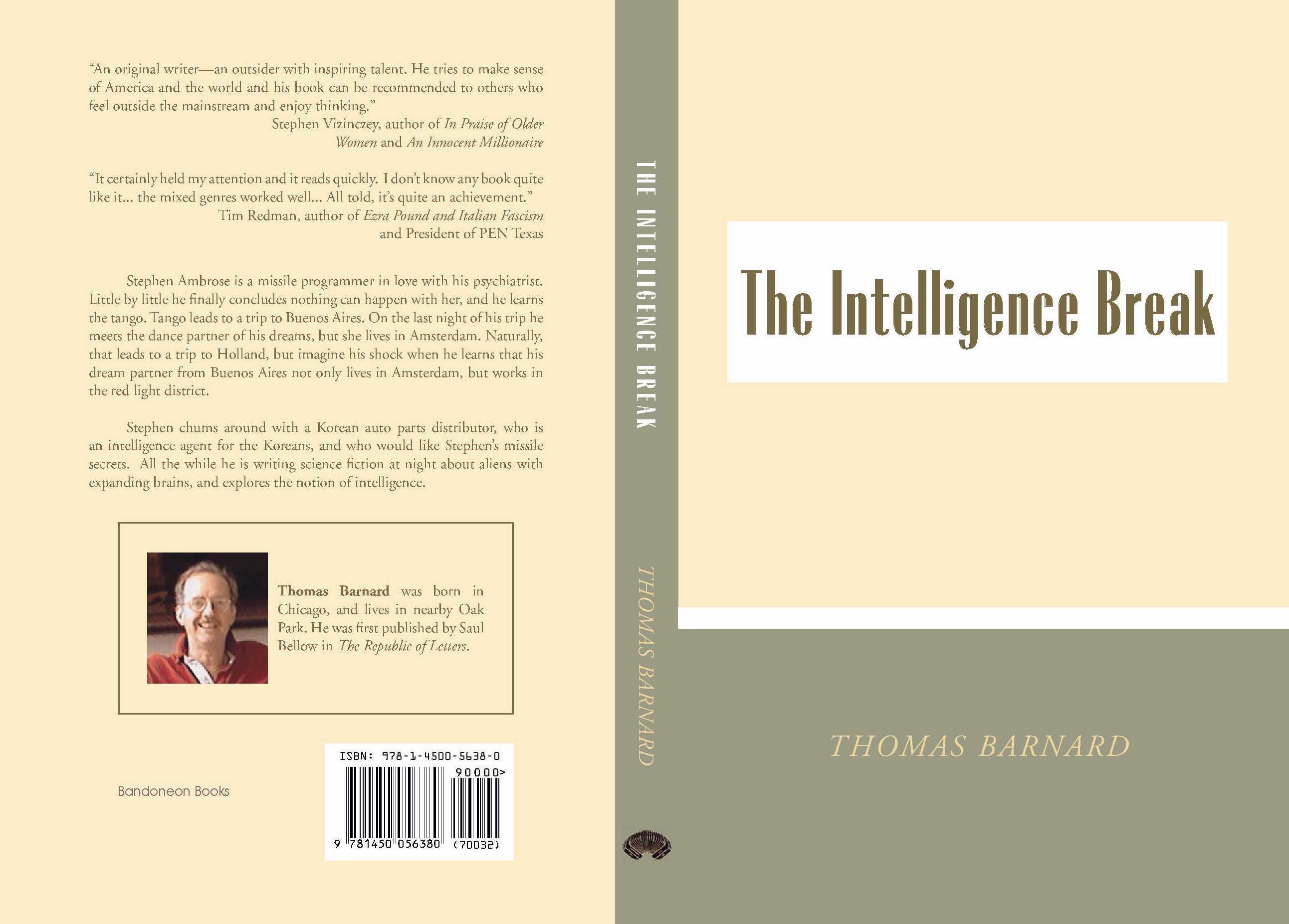

The Intelligence Break, a novel about the curious relationship between brains and sex

Check it out: http://www.theintelligencebreak.com/

And to those within striking distance of Oak Park, the book I expect should be available some time in June at:

The Book Table

1045 Lake Street

Oak Park, IL 60301

708-386-9800